U.S. immigration is complex, especially when ensuring financial support for family-based and certain employment-based immigrants. The I-864 Affidavit of Support plays a pivotal role in this process. In this post, we review USCIS Form I-864 and provide an understanding of its purpose, requirements, and implications for sponsors.

Understanding the I-864 Affidavit of Support

The I-864, Affidavit of Support Under Section 213A of the Immigration and Nationality Act (INA), is a legally enforceable contract between a sponsor and the U.S. government. It demonstrates that the immigrant has adequate financial support and is unlikely to rely on U.S. government assistance.

Key Components and Requirements

- Form I-864 Edition Date: Always use the form edition dated 12/08/21, available on the USCIS website.

- Filing Locations: The USCIS Lockbox Filing Locations Chart will guide you to the correct address based on your residence.

- Filing Fee: It varies depending on whether you file within or outside the United States. Check the USCIS or the Department of State website for specifics.

Documentation Checklist

Ensure you provide:

- For All Sponsors: Send a copy of your recent federal income tax return, including W-2s, or a statement explaining why you didn’t file.

- For Some Sponsors: Specific documents are required for self-employed individuals, those sponsoring multiple immigrants, military sponsors, and those using household income or assets to qualify.

Understanding the Duration of Sponsorship

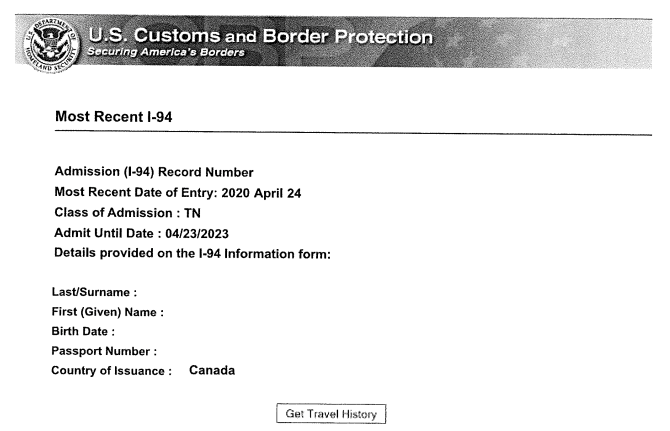

The affidavit’s commitment lasts until the sponsored individual becomes a U.S. citizen or has worked for 40 quarters. It’s important to note that divorce does not end the sponsorship obligation.

Responsibilities of the Sponsor

Sponsors are financially responsible for the immigrant and must reimburse any means-tested public benefits the immigrant uses. This obligation also extends to co-sponsors and household members who contribute to the financial requirement.

“Means-Tested Public Benefits” Defined

Familiarize yourself with federal and state means-tested benefits, such as food stamps and Medicaid, to avoid unintended liabilities.

Navigating the Sponsorship Journey

The I-864 Affidavit of Support is more than paperwork; it’s a commitment to support a family member or employee embarking on a new life in the U.S. By understanding and carefully fulfilling these obligations, sponsors play a crucial role in the successful integration of immigrants into American society.

Empower yourself with the knowledge of the I-864 Affidavit of Support to ensure compliance and make informed decisions throughout the sponsorship process. Remember, this guide is a starting point. Always consult with immigration experts for personalized advice and the most current information.

Subscribe to Our Resources Blog

Schedule a Consultation with an Immigration Lawyer

Citations

We Can Help!

You may have questions regarding U.S. Immigration Sponsorship. We invite you to contact our team at Richards and Jurusik for detailed guidance and assistance. We aim to provide the most accurate and up-to-date information to make your immigration process smoother and less stressful. The immigration lawyers at Richards and Jurusik have decades of experience helping people to work and live in the United States. Read some of our hundreds of 5-star client reviews! Contact us today to assess your legal situation.