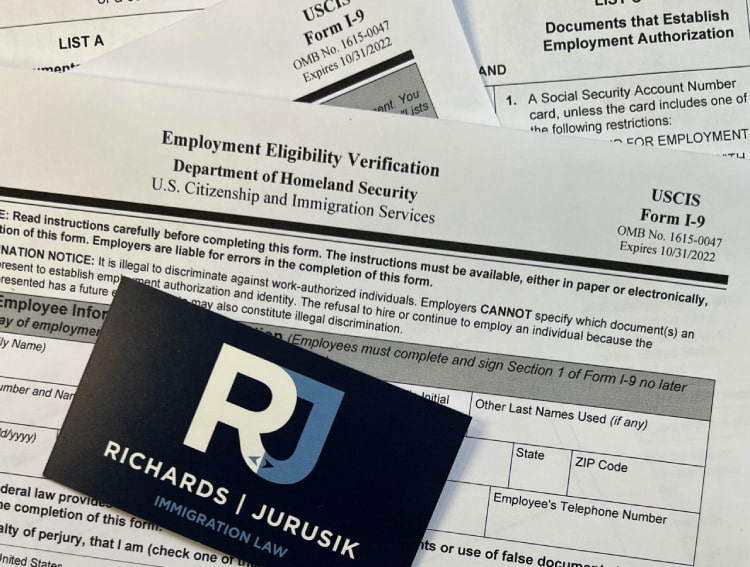

The USCIS Form I-9 is not merely administrative paperwork but crucial for verifying employment eligibility for U.S. citizens and non-citizens. Here, we go into the vital details every employer must know to navigate this process smoothly.

Critical Deadlines for Completing Form I-9

Meeting specific deadlines is fundamental for the efficient completion of Form I-9:

- Section 1: Employees must fill out Section 1 and provide the necessary documentation after accepting a job offer before their first day of paid work.

- Section 2: Employers must complete Section 2 by the third business day after the employee begins their job.

Storing and Managing Form I-9 Records

Despite the misconception, USCIS Form I-9 does not need to be submitted to the USCIS. Instead, employers should:

- Keep a correctly completed Form I-9 for each employee.

- Retain Form I-9 records for three years from the hire date or one year after employment ends, whichever comes later.

- Be ready to present Form I-9 documents for inspection by U.S. government officials upon request.

Who is Exempt from Completing Form I-9?

While Form I-9 is a requirement for most employees, there are notable exceptions:

- Employees hired on or before Nov. 6, 1986, who are continuously employed.

- Casual domestic workers are employed on a non-regular basis.

- Independent contractors or those employed by a contractor.

- Individuals who do not physically work in the United States.

The Legal Requirements

Employers must understand that hiring an independent contractor known to be unauthorized to work in the U.S. is unlawful. Adhering to Form I-9 regulations is a legal mandate for all employers.

Conclusion

Grasping the intricacies of the USCIS Form I-9 is vital for employers aiming to ensure compliance with employment verification requirements. This guide serves as a key resource for staying informed, guaranteeing compliance, and optimizing your employment verification process.

Subscribe to Our Resources Blog

Schedule a Consultation with an Immigration Lawyer